What is SAP S4HANA Finance?

SAP S/4HANA is short for SAP Business Suite 4 SAP HANA. It is a new era business-series

acquiring in-memory staging. SAP HANA is used with the SAP FIORI user

experience. It is designed to blend with Internet of Things, Mobile Networking,

Business Networks, Big Data, third party applications/ software, and much more

and utilize their applications. It is immediate, intelligent and integrated.

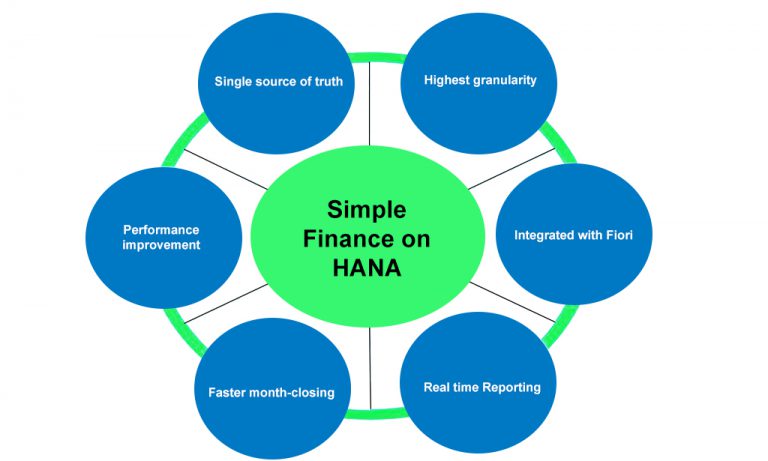

Why SAP S/4HANA Finance?

The world is stepping towards globalization and connected

platforms day-by-day. Thus, due to this, data is unveiling a rapid growth

exponentially; process integrity and requirements related to governance have

debuted to be more than expected. Because of this, SAP ERP’s aim to provide

real-time data processing has become kind of unachievable. This steered to the

development of SAP S/4HANA Finance which has become a renowned trademark in

attaining this aim. This newly revamped user-interface not only uses in-memory

knacks, it also incorporates those knacks to consolidate all areas like

business management, financial accounting and the like. It helps in increasing

flexibility (especially in accounting) during closing and end year reporting by

stocking all finance related info. With SAP S/4HANA Finance, it has become very

elementary to obligate new financial and technical transfiguration or

metamorphosis in an organization thus leading to a more versatile growth. This

also shores up new ERP enactments that may come in ERP in the time ahead.

Some of the supplementary features of notable relevance include:

- Superfluity decreased thus broadening performance levels: Many superfluous database tables and indexes have been expunged and this has led to a drastic broadening in the performance.

- Code pushdown: Data processing is now working directly with SAP database which has boosted the performance.

- Data footprint: It can be considered as a reduction of the financial data to the one-fifth of its initial size (because of compression techniques being involved).

- Reduction in the process steps.

- It can tolerate added and its capabilities include extensive workload situations.

- There are many choices of deployment, some of which include cloud deployment, on-premise deployment, hybrid deployment etc.

- The types of data being refined include social, text, geo, graphs etc. It can predict, recommend and simulate.

- Industry enablement allows customers from broader set to quickly and use SAP S/4HANA due to its integration with EVM.

- ATP, Catalogue management and untangled MRP forethought along with a lot of new apps are instigated. This has increased value for manufacturing up to a great extent.

- Assimilation of key functions like EWM, PLM, PPM, MDG, GTS etc has allowed the businesses to devote into the digital core.

SAP S/4HANA Finance courses available on

Open SAP are:

SAP S/4HANA in a nutshell

SAP S/4HANA-Deep Dive

SAP S/4HANA-Use Cases

Implementation of SAP S/4HANA

Financial

Planning and Analysis

With SAP S/4HANA Finance processes for FP&A, a steep rise in

planning cycles, profits, and efficiency of the financial functions can be achieved.

Time lags and layoffs can be, diminished or we can say, eliminated by including

the real-time data which is operating and from first-to-last arrangement

processes. The analysis can be run at any level of granularity because of table

in-memory platform. The different levels of financial planning cycle like

development, updates, and reporting are supported by this tool. It also allows

for continuous group accounting, integration with Ariba and other tools for

better management.

Accounting and Financial

Close

SAP S/4HANA Finance processes for accounting and financial close are

aimed at decreasing closing workloads, costs corresponding to it and to make

the whole process much faster, thus reducing the time drastically that is being

consumed (without its help). It is directed at managing all the closing-related

tasks and processes in real time. The whole process uses isolated and blended

data model thus entwining the operations and introducing intelligibility in the

executions thus reducing dangers and errors. Entire depreciation is run by

means of logic and data structures.

Treasury and financial

risk management

SAP S/4HANA Finance processes for Treasury and Financial Risk

Management amalgamates analysis related to cash-flow, stocks in trade, business

planning, obtaining real-time insights of bank balances and currency details

and increments executive engagement with modern user interface.

Collaborative Finance

Operations

SAP S/4HANA Finance processes for alliance finance enterprises lets

us scrutinize and react to fluctuating market spirits. Auditing how patron is

paying, carving customer reciprocations all in real-time. Aspiration of

customer’s beneficence and helpfulness examination using painless techniques

and methods.

So, last but not the least, with SAP S/4HANA Finance, one can spurt

big processes on a colossal scale and streamline technology with its system

meant for discarding data layoffs, data replica etc, one can design the whole

process again according to his compulsions for increasing flawlessness to focus

on critical tasks and omissions and take convenience of this benign path. This

finance supplement outs the classical Financial nuisance in SAP ERP system. All

aggregations and indexes are removed and are now calculated on the fly.

SAP Trainings Online is

the world’s biggest resource of learning platform online will teach you the

industry used technologies and methodologies and make you future ready in your

chosen module and chosen platform. You can open SAP training courses to know

more about training options.

Register with us for

free demo on SAP simple finance training:Click Here

For more training details visit: www.saptrainingsonline.com

Email:Contact@saptrainingsonline.com

Contact: INDIA +91 9052775398 USA +13152825809

Comments

Post a Comment